1. Trend-Following Strategies (~2 minutes)

These strategies aim to capitalize on sustained price movements (up or down).

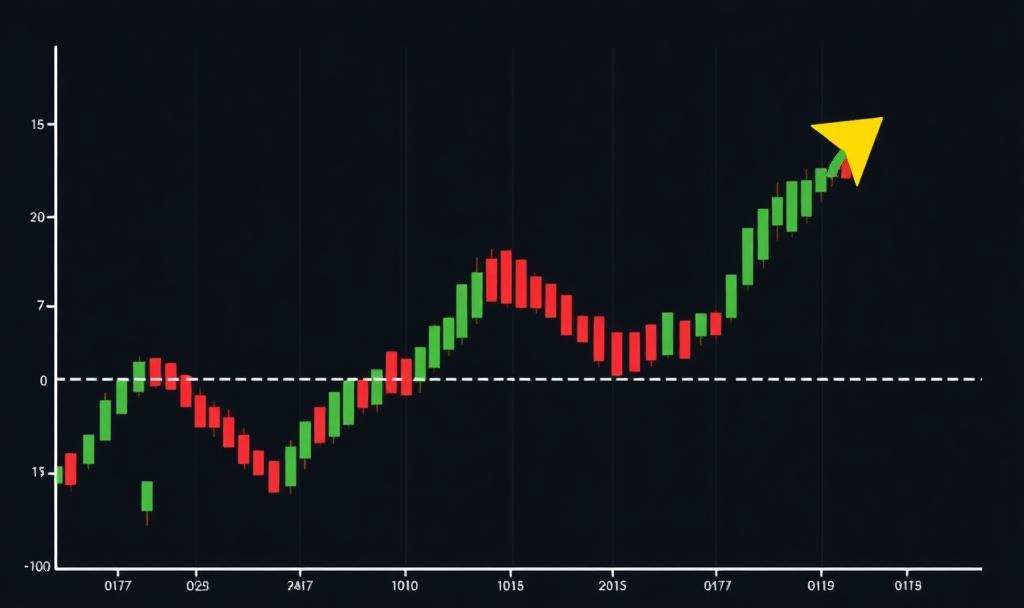

Moving Average Crossover: Buy when a short-term moving average (e.g., 10-day) crosses above a long-term one (e.g., 50-day); sell when it crosses below. Works in trending markets but lags in choppy ones. Risk: False signals during sideways markets.

Breakout Trading: Enter trades when the price breaks through key support/resistance levels (e.g., 52-week highs). Often uses volume confirmation. Risk: False breakouts can lead to losses.

Trend Momentum: Uses indicators like RSI or MACD to confirm the strength of a trend before entering. Risk: Overbought/oversold signals can mislead in strong trends.

Use Case: Best for markets with clear directional moves (e.g., bull or bear markets).

2. Mean Reversion Strategies (~2 minutes)

These assume prices will revert to their historical average after deviating.

Bollinger Bands: Buy when the price hits the lower band (oversold) and sell at the upper band (overbought). Risk: Prices can stay extreme longer than expected.

Pairs Trading: Trade two correlated assets (e.g., Coke vs. Pepsi). Go long on the underperformer and short the outperformer, betting on convergence. Risk: Correlation can break.

Reversal Trading: Enter trades when indicators (e.g., candlestick patterns like hammers) suggest a trend is exhausted. Risk: Misjudging reversals can lead to entering too early.

Use Case: Works in range-bound or oscillating markets.

3. Arbitrage Strategies

(~1.5 minutes)

Exploit price differences across markets or instruments.

Pure Arbitrage: Buy an asset cheaper on one exchange and sell it higher on another simultaneously. Example: Bitcoin priced at $60,000 on Exchange A and $60,100 on Exchange B. Risk: Requires fast execution and low fees.

Statistical Arbitrage: Uses algorithms to identify mispricings in correlated assets (e.g., ETFs vs. underlying stocks). Risk: High-frequency trading competition and tech costs.

Triangular Arbitrage: In forex, exploit exchange rate discrepancies (e.g., USD → EUR → GBP → USD). Risk: Tiny margins and high transaction costs.

Use Case: Best for high-frequency traders with advanced tech.

. Momentum and Scalping Strategies

(~2 minutes)

Focus on short-term price movements for quick profits.

Scalping: Make dozens of trades daily, capturing small price moves (e.g., 5-10 pips in forex). Relies on tight spreads and high liquidity. Risk: High transaction costs and stress.

News Trading: Trade based on market reactions to events (e.g., earnings reports, Fed announcements). Risk: Volatility can lead to slippage or unexpected moves.

High-Frequency Trading (HFT): Uses algorithms to execute thousands of trades in milliseconds, exploiting tiny price inefficiencies. Risk: Requires massive investment in tech and infrastructure.

Use Case: Suited for active traders in liquid markets like forex or equities.

Algorithmic and Quantitative Strategies (~1.5 minutes)

Rely on data-driven models and automation.

Trend-Following Algos: Automate entries/exits based on technical indicators. Risk: Black-box systems can fail in unexpected conditions.

Machine Learning Models: Use AI to predict price movements based on historical data. Risk: Overfitting to past data.

Market-Making: Provide liquidity by placing buy and sell orders simultaneously, profiting from the spread. Risk: Inventory risk if the market moves against you.

Use Case: For tech-savvy traders with programming skills.